You notice that, wow, this company is on point! Highest current ratio you have ever seen.Īnd look at Accounts Receivable - it’s three times higher than you would have expected, nice!Īs a smart analyst, you know the importance of getting the complete picture. Let's say you are analyzing a company and the first thing you look at is its current ratio. This usually means raising additional capital, or taking on more debt. Slow turning assets can force a company to find other ways to pay for day-to-day operating expenses. Higher assets could mean that the company isn’t generating revenue and cash flow from its resources. Well, there could be a problem with this scenario. I thought assets were a good thing? Those assets have value and they’ll get money eventually, so what’s the big deal if it takes a while? If a company has too much of their money tied up in assets, this can lead to shortfalls in operating cash flow.

:max_bytes(150000):strip_icc()/FAturnover2-9e6e847dff114551adf1998faec96921.jpg)

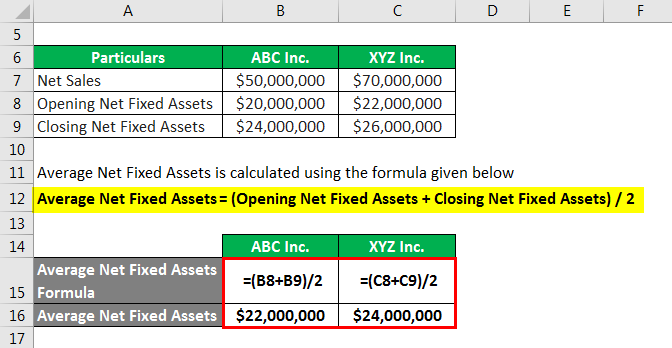

This additional capital can then be reinvested back into operating activities to generate more growth. Strong companies use their assets to create additional cash flow and revenue for their business. What are Asset Management Ratios and What Do Asset Management Ratios Indicate?Īsset management ratios measure how effectively and efficiently a company is using its assets to produce sales and grow the business. A list of asset management ratios and formulas.īy the end of this article you'll have everything you need to measure whether a company is successful at using its assets effectively.In today’s post we'll cover a few main points, including: Also known as, efficiency ratios or turnover ratios. The answer is found by analyzing a company’s asset management ratios. Successfully using assets to generate sales growth is a key trait of strong companies.

0 kommentar(er)

0 kommentar(er)